Traders often look for strong patterns to get early entries. The Evening Star is one such pattern that can offer a strong and early bearish entry. It is considered one of the most reliable indicators of a potential trend reversal. The pattern usually forms at the top of an uptrend.

An Evening Star pattern is a triple candlestick pattern that can help traders predict a good entry point for bearish trades. Hence, it is a bearish reversal candlestick pattern.

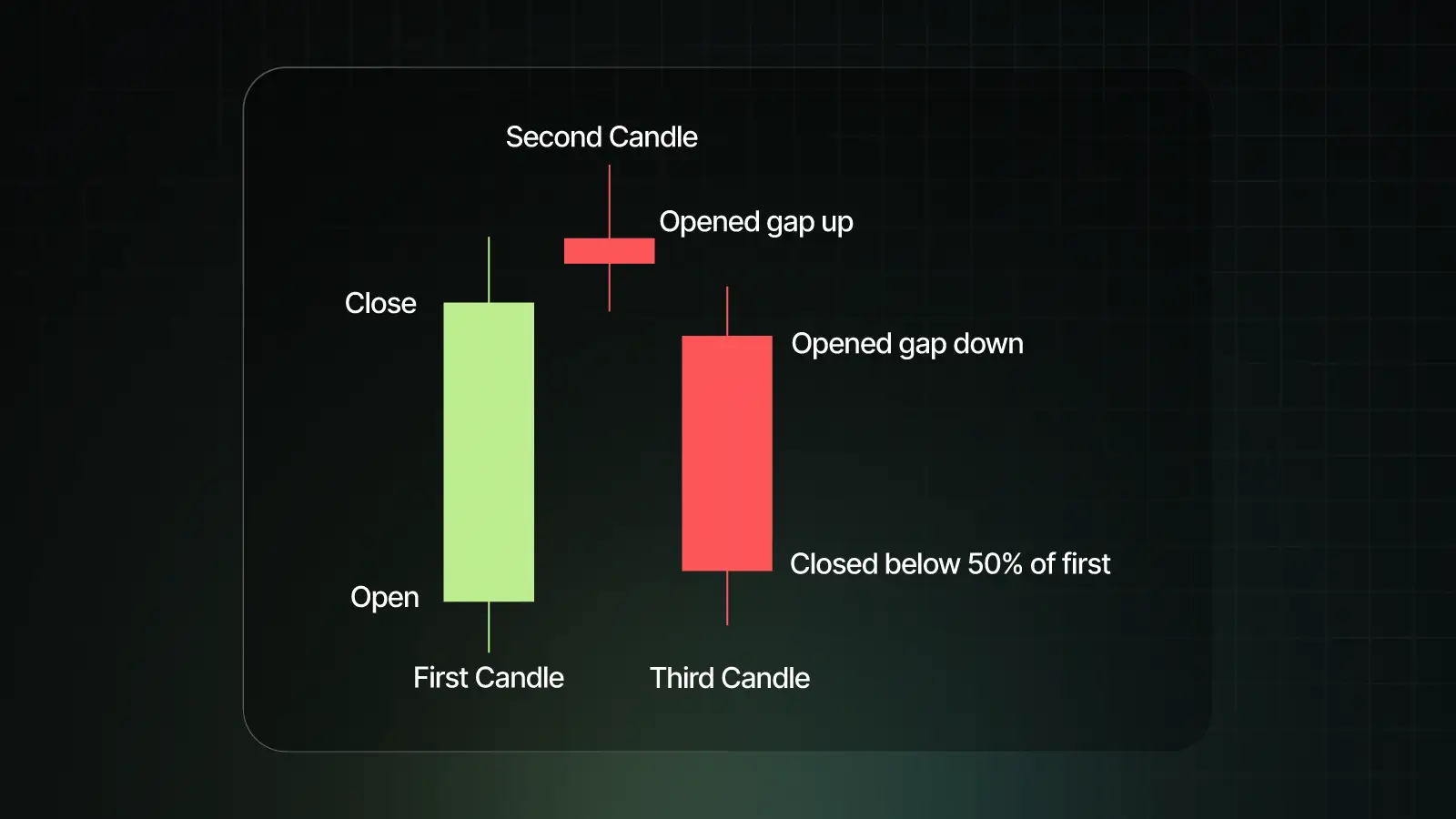

Here is how the Evening Star pattern looks:

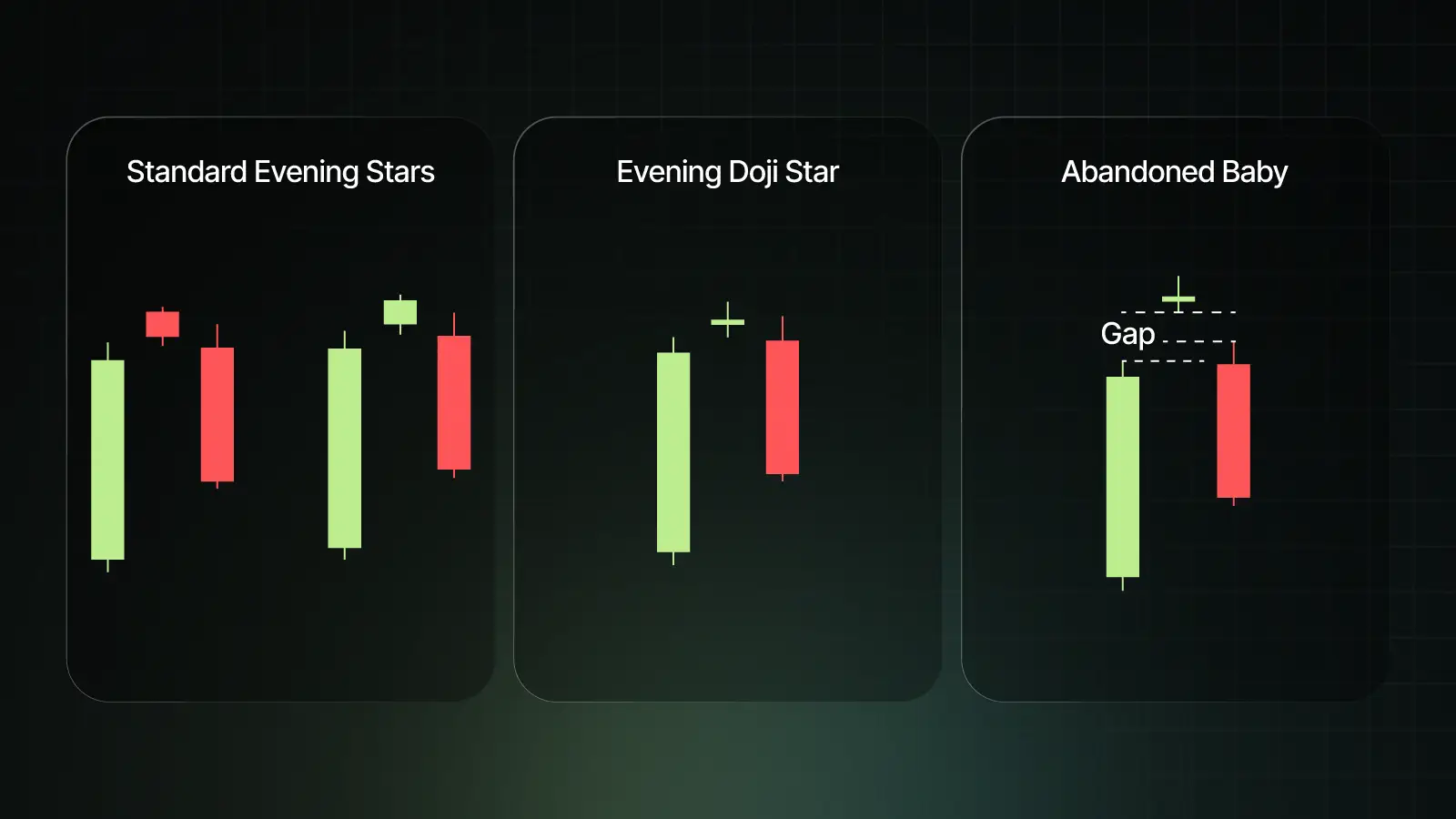

Apart from the usual evening star pattern, there are some modifications as well:

Here are the differences between them:

|

Pattern |

Middle Candle |

Gap Needed? |

Strength |

Easy Explanation |

|

Evening Star |

Small candle (bullish/bearish) |

Gap not required (but helps) |

Strong |

Normal 3-candle bearish reversal |

|

Evening Doji Star |

Doji (open = close) |

Small gap above 1st candle (better) |

Stronger |

Doji shows clear indecision before reversal |

|

Abandoned Baby |

Doji or tiny candle |

Must gap up after 1st & down before 3rd |

Very Strong & Rare |

Middle candle “stands alone” → powerful reversal |

This is a bearish reversal pattern. The pattern works best when it is formed in an uptrend. If you find an Evening Star during a downtrend, it can be safely ignored. It is, in fact, essential to understand that for trading any pattern, the prior trend must be analysed carefully.

The Evening Pattern is most effective following a prolonged uptrend. The reliability increases further if volume rises on the bearish candle. Additionally, if we can identify strong resistance at the high of the second candle, this provides even more confidence in the setup. Some ways of confirmation are using the following indicators:

To trade the evening star, once it has formed after a significant uptrend, we can go for short trades. The entry can be done in 2 ways: either the trade can be taken at the break of the low of the third candle. Or, conservative traders can wait for the candle to close below the third candle low to take the entry.

Once the entry is made, the stop-loss is usually set at the high of the second/third candle. Since the trades are being done at a good resistance level, the targets can be either the next support zone or use a risk-reward ratio (1:2 or 1:3).

If you want to increase the accuracy, you may like to wait for extra indicator confirmation.

Let's take an example of ICICI Bank on a daily timeframe.

The market was in a clear uptrend. Then there was a large green candle, followed by a doji candle (accompanied by a gap up). The next candle was a gap-down red candle. The short entry can be taken the next day at the low of the third candle, with the stoploss at the high of the third candle. The target can be put at a risk-to-reward ratio of 1:2 or 1:3, which was achieved around 5 Apr 2025.

The Evening Star pattern has both strengths and weaknesses. It works well during trending markets and can give a clear bearish reversal signal. It is strongly reliable with confirmation. However, it can fail in sideways markets and needs volume/indicator support.

The Morning Star is a bullish reversal pattern, the opposite of the Evening Star. Here are the differences between Evening and Morning Star:

|

Aspect |

Morning Star |

Evening Star |

|

Trend Context |

Appears after a downtrend |

Appears after an uptrend |

|

Signal Type |

Bullish reversal |

Bearish reversal |

|

First Candle |

Long bearish candle |

Long bullish candle |

|

Second Candle |

Small body / Doji (indecision) |

Small body / Doji (indecision) |

|

Third Candle |

Strong bullish candle closing into the 1st |

Strong bearish candle closing into the 1st |

|

Market Psychology |

Sellers lose control, buyers take over |

Buyers lose control, sellers take over |

The Evening Star is a very popular bearish reversal pattern that works very well if the reversal occurs after a strong uptrend. The pattern becomes even stronger when the reversal occurs at a strong resistance level, which can provide further confidence to the trader to take the short entry.

It can also be combined with other tools, such as RSI, MACD, or Supertrend, which helps increase the accuracy of the pattern. If the pattern is used wisely, the Evening Star can help traders anticipate potential downturns and manage risk more effectively.

Frequently Asked Questions

Q1. What is an Evening Star candlestick pattern?

The Evening Star pattern is a 3-candle bearish reversal formation appearing after an uptrend.

Q2. Is the Evening Star a bearish signal?

Yes, if the pattern appears after a prolonged uptrend, it suggests a potential reversal of the downtrend.

Q3. How to identify it on different timeframes?

The patterns work most reliably on bigger timeframes, such as daily and weekly charts. If traders want to use this pattern on intraday charts, then they should get a double confirmation from other indicators.

Q4. What indicators confirm the pattern?

Some of the indicators that can help confirm the pattern are RSI (overbought), MACD bearish crossover, and supertrend.

Q5. How does it compare to other bearish patterns?

The Evening Star pattern is more precise and more reliable than single bearish candlesticks, such as a shooting star. Some people consider it as good as bearish engulfing or a Head & Shoulders pattern.

Vaishnavi Tech Park, South Tower, 3rd Floor Sarjapur Main Road, Bellandur Bengaluru – 560103, Karnataka

© 2025 915.trade by Groww. All rights reserved.