Every trader is looking for ideas to know when a stock, which has been falling for quite sometime can give a reversal. Morning Star is one such bullish candlestick reversal pattern. It is triple candlestick pattern which can help traders to find when the stocks have bottomed out and can give a bullish reversal. The pattern is especially useful when it forms during a downtrend. Moreover, the pattern can be considered a strong sign of trend reversal if there are high volumes during the same time.

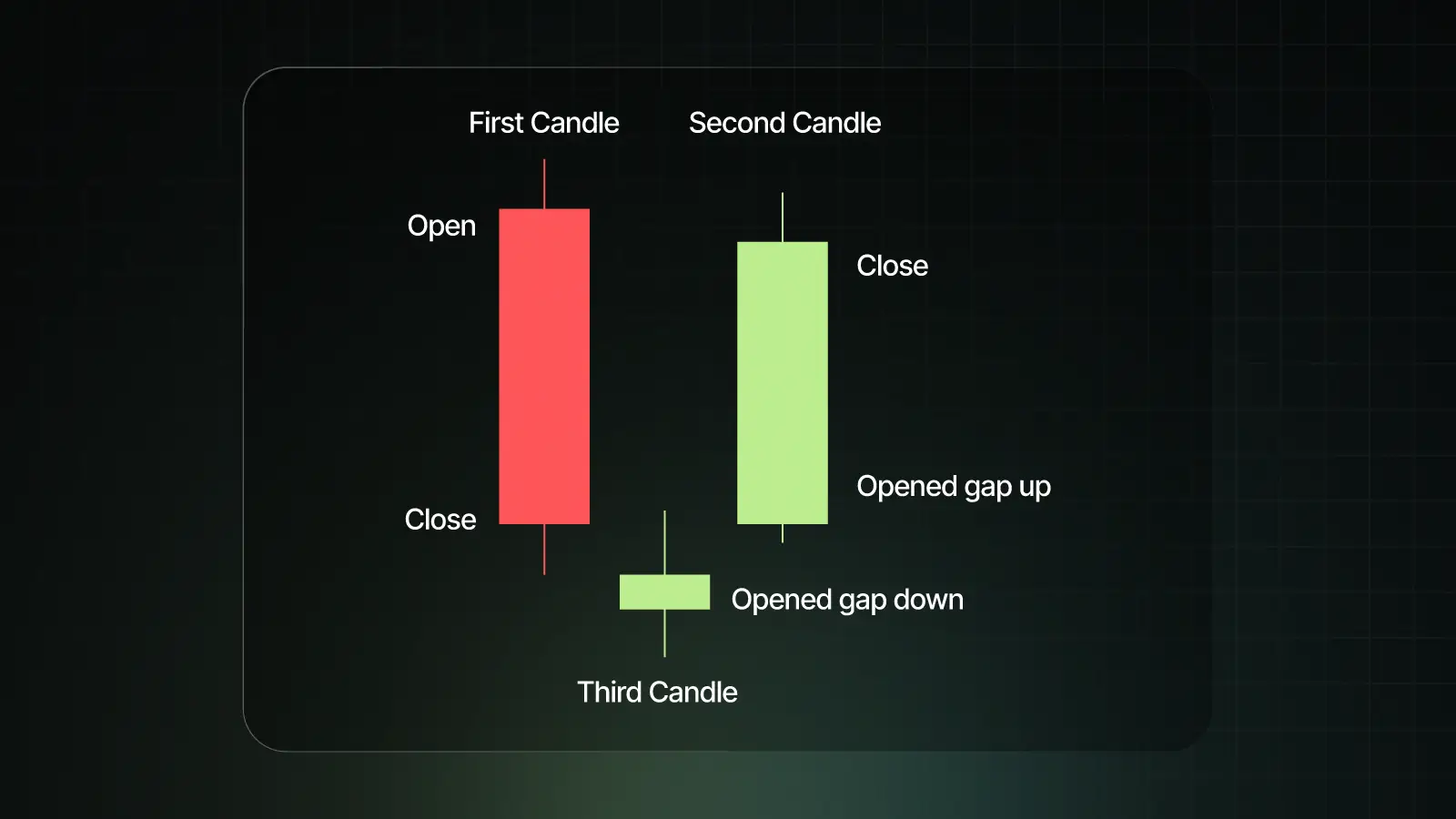

Here is how the morning star pattern looks like:

The pattern consists of three candles:

The morning star pattern indicates great market psychology. The bears were in control and there was a consistent downtrend. The first candle also showed continuation and there big red candle formation. But then during the second candle, even though the market gapped down, which suggested that market will continue to fall, there was a strong support and an indecision in the market. The bears were not able to move the market further down. Many times the second candle is a doji, which further shows that the market might be going for a reversal. Finally, the third day, market reverse and bulls regain strength and confirm reversal. And this is a strong reversal because there was a gap up, which shows that bulls have broken through the downtrend and are planning to take the market up.

Like with all the candlestick patterns, there are some idea conditions that makes Morning Star much more potent. Here are some idea conditions for it be a great reversal pattern:

Morning Star pattern is traded after the three candles have completely formed. Usually, the entry happens when the high of the third candle is broken. The usual stoploss is slightly below the low of the second candle. The target can be placed in different ways. Either, the trader can do a risk to reward of 1:2 . So, if the risk is 10 points (entry price – stoploss price), then the potential target can be 20 points. Another way to place a target is at next resistance level.

Let us take an example to show how Morning Star pattern works. In this example, we will see what can be the potential entry and exits after using the pattern. Below is the daily chart of ZYDUSLIFE.

There was a clear downtrend for several days and then there was a red candle in continuation to the downward trend. The next day there was a spinning top after a gap down. And next day, the market gapped up convincingly and made a green candle. This was the completion of the Morning Star pattern. Traders could have taken the Buy trade the next day once the high of the third candle was broken. The stoploss would have been the low of the middle candle. We can see from the chart that the market did come done, but it did not hit the stoploss. And then market went up hitting the target of 1:2 risk to reward.

Some of the strengths of Morning Star pattern are:

Some of the weaknesses of the Morning Star pattern are:

Morning Star pattern can be a good potential when combined with other indicators. Here are some ways, other indicators can be used along with Morning Star pattern:

|

Indicator |

How It Helps with Morning Star |

Confirmation Signal |

|

RSI (Relative Strength Index) |

RSI tells whether the market is overbought or oversold |

RSI going from below to above 30 signals that uptrend is starting |

|

MACD (Moving Average Convergence Divergence) |

MACD can help in determining sentiment shift |

MACD bullish crossover gives double confirmation |

|

Volume |

Volume tells the strength of the move |

The volume of the third candle is important and should be highest among the three candles for double confirmation |

|

Support/Resistance Zones |

The zones help in finding strong reversal areas |

Morning Star near major support is more trustworthy |

|

Moving Averages (50/200 EMA) |

Confirms overall trend direction |

If the morning star Pattern is formed at moving average, this is a particularly strong reversal signal |

Morning Star is a reliable bullish reversal pattern consisting of triple candles. The pattern works well when the market has been in the prior downtrend, the entry comes near support level and high volumes are observed during the entry. The pattern becomes more potent when it is combined with other indicators. However, always remember that not all trades taken using this pattern will be profitable and hence risk management is super important.

Frequently Asked Questions

Q1. What is a Morning Star candlestick?

Morning Star is a three-candle bullish reversal pattern, which is used to get a potential trend change idea after a downtrend.

Q2. When does the Morning Star pattern work best?

The pattern works best when there is a prior downtrends, and when the pattern is created at strong support zones.

Q3. How to confirm the Morning Star signal?

The potency of Morning Star pattern can be made stronger by looking out for strong bullish third candle, volume confirmation, and supporting indicators (RSI/MACD).

Q4. Is this pattern useful in intraday trading?

Yes, the pattern can be used for intraday trading. However, the reliability increases on higher timeframes like daily/weekly. If Morning Star patter is used in intraday, volume and other indicators should be used for double confirmation.

Q5. What are its limitations?

The pattern is prone to giving false signals in sideways markets, and without volume/indicator confirmation, it may fail.

Vaishnavi Tech Park, South Tower, 3rd Floor Sarjapur Main Road, Bellandur Bengaluru – 560103, Karnataka

© 2025 915.trade by Groww. All rights reserved.